|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Piloten ‚im Ruhestand’ sind dringend auf Übergangs- u. Altersversorgung angewiesen.

· Die kritische Altersphase ohne sicheres Einkommen ist 60 bis 67. Mehrfache Gründe

Alter 60 (ggf. Ausscheiden als Pilot) – Alter 63 (Ende einer evtl. Übergangsversorgung) – Alter

65 (Ende der Tätigkeit lt. Arbeitsvertrag) – Alter 67 (69 bereits im Gespräch – Beginn der

künftigen Soz. Vers. Rente)

· Die Sozialversicherung kennt keine Übergangsversorgung für Piloten ab Alter 60.

Vorgezogene Altersrente ‚als Ersatzlösung’ hieße Rentenkürzung.

· Folge - Frühe Eigenvorsorge als einzige Lösung der leidigen Einkommensfrage ab 60.

· Anwendung – Die wählbaren Versionen Einmalzahlung – und/oder abgekürzte

Jahreszahlung – und/oder laufende Beitragszahlung lassen sich nach den individuellen

Gegebenheiten und Möglichkeiten frei und rentabel kombinieren.

· Idealfall – Eine Form des ‚Pilotensparbuchs’ der besonderen Form. Jederzeit

zwischen 60 bis 67 frei verfügbare, abrufbare Geldsumme, verzinsliche Anlage ohne

typisches Risiko, freie Verwendung/Wiederanlage oder Bezug, gesicherte Rückzahlung,

unabhängig von Fluggesellschaft/Arbeitgeber - u n d zudem wird die

· Ansparphase zu 100% abgesichert gegen das Risiko des vorübergehenden

oder endgültigen LIZENZVERLUSTES - VERLUSTES DER TAUGLICHKEITSKLASSE I.

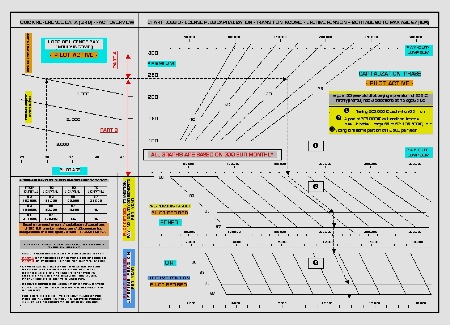

How to use the graphs and what shall be carefully observed to

build up sufficient income when retired from flight duty.

LOL-Graph2.pdf |

Graphs are based on a premium spending of 300 EUR a month. Part A

(a part of 300 EUR) has to be spent for loss-of-license risk. Part B (a main part

of 300 EUR) will be be spent for capitalizing. Part B is source of your investment

for retirement income. Example: A 30 year young pilot who pays a premium of 300

EUR monthly does so for retirement capitalization with a premium Part B who

reads 232 EUR a.m..This share has to be increased from time to time when a

surplus to your pension is wanted or necessary f.e.due to an increased salary.

· For individual use: If you can/must invest an amount of 600 EUR for a

standard of living when active flight profession has ended: You double all graph

figures by multiplying with figure 2.

· Graphs shall merely give a rough information and imagination how money

investment (without risks) works for your benefit of retirement income upon your

personal savings as a consequent effort.

· Graphs are evaluated for short/speedy overview and preplanning. Precise

calculations for the individual pilot are inevitable. A long term decision concerning

your income after any age beyond 60 – for the time being – cannot be made based

on a false thinking about how time in years and amount in money/currency

influence a retired pilot’s income or his standard of living.

· Please understand precisely that an inflation rate is hooked up by a

dynamic premium – meaning a regular yearly increase of premium by 5 %. It’s

merely but necessary to equalize inflation rate. This should not be mixed up with

the policy detail of a free / not prefixed call of a lump sum capital / payout within

a flexible phase starting at an age of 60 up to max age 67 in our case. This results

in the graphs showing increased payouts of capital, rents and pensions (whatever

is your choice) at higher age.

· The idea is simply to start a very normal procedure as you would do it within

a mere saving bank program. No risk is wanted but reliability on an income. As well

the plan should never ever be complicated but kept easy to understand. In case of

bad circumstances your family should have a save abnormal and emergency grip on it.

· The graphs advise clearly: As sooner and as higher your pension investment

grows – also even required for a transition time of a few years – it will be started as

sooner it is a fundament to your benefit and prosperity for life. A decision to invest

less or doing other money spending instead of in time can only be corrected by several

unusual great efforts later on or never ever afterwards. Preparing your pension as early

as possible is not ‘a piece of cake’ but far better than a 600--$ -job as a trucker on a

wreckage ground towing ‘shredlifters’ to their last destination like a photo shows:

FLYER-LOL-FAX-RÜCKANTW10512.pdf |

- see also pdf download as stated above resp. below -

LOL-Graph-pdf |

Prosp-COCK-FUT-B-22711.pdf |

FLYER-LOL-FAX-RÜCKANTW10512.pdf |